The European Central Bank (ECB) is laying the groundwork for the probable launch of its wholesale and retail central bank digital currency (CBDC), the Digital Euro. Christine Lagarde, President of the ECB, shared this update at their latest press conference. “President Lagarde stressed that the digital euro is ‘more relevant than ever,’” the ECB tweeted.

Lagarde emphasized that the Digital Euro, the EU’s CBDC solution, is set to launch in October 2025—provided it passes the legislative phase involving key stakeholders, including the European Commission, Parliament, and Council. Notably absent from this process is the European public, despite the significant impact this initiative will have on their daily lives.

Why Is the Digital Euro More Relevant Than Ever?

Could it be linked to Ursula von der Leyen’s recent “ReArm Europe” announcement, which proposes the creation of an EU army? This initiative requires an estimated €800 billion in funding—money the EU does not have. The options? Extracting it from EU member states and their citizens or printing fresh funds via the ECB. Either way, it’s time to warm up the ECB’s money printers!

Furthermore, The EU has introduced the “Savings and Investments Union”, aiming to redirect €10 trillion in “unused savings” from citizens to finance military growth and bolster Europe’s defense industry. “We’ll turn private savings into much-needed investment,” tweeted von der Leyen. If this hasn’t shocked you already, I’ll try to clarify: This is a clear violation of private property rights, and an implicit confiscation of Europeans’ wealth, while bluntly using their funds as the EU sees fit, including funding of a military industrial complex, without even asking them.

If the EU is accelerating toward totalitarian collectivism, as this statement suggests, then a CBDC would be a powerful tool—enabling tighter control over Europeans’ money with features like an “on/off” switch and programming abilities.

Christine Lagarde recently campaigned at the European Parliament, arguing that the Digital Euro is necessary to reduce the EU’s dependence on foreign payment solutions. European banks must innovate payment methods, but the EU’s primary concern isn’t just reliance on tech giants like Google Pay or Apple Pay—it’s the potential for widespread adoption of decentralized global protocols like Bitcoin.

The ECB is observing geopolitical trends, noting that the U.S. is embracing crypto, Bitcoin, and stablecoins—technologies that pose a risk to centralized control. Unsurprisingly, they are choosing a different path. According to Reuters, “Eurozone banks need a digital euro to respond to U.S. President Donald Trump’s push to promote stablecoins” as part of a broader crypto strategy. ECB board member Piero Cipollone reinforced this stance, stating, “This solution further disintermediates banks as they lose fees, they lose clients… That’s why we need a digital euro.”

Bottom line, Lagarde’s and Von der Leyen’s recent agendas are aimed to drive more centralised control while strengthening the EU hierarchy, governance and incentive structure – that has always been their role.

New Digital Euro CBDC Survey

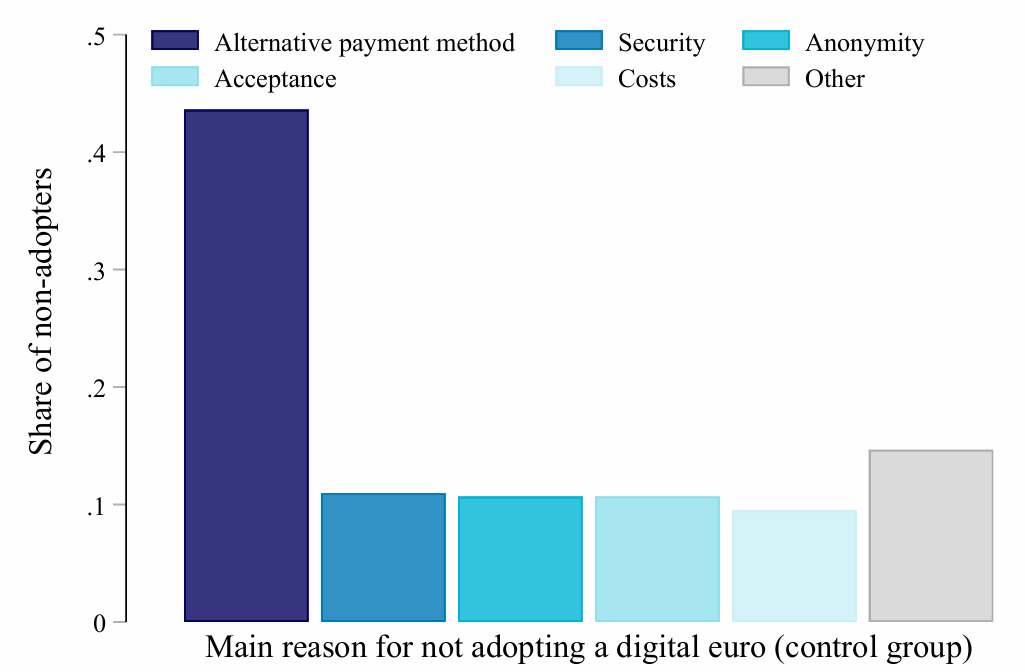

The ECB recently published findings from a survey on consumer attitudes toward retail CBDC, conducted among 19,000 Europeans across 11 Eurozone countries. Key takeaways include:

1) Lack of Interest – Most Europeans are not interested in the Digital Euro, as existing payment methods already serve their needs well.

2) Europeans are Open to Propaganda – While public interest is low, the survey found that Europeans are receptive to video-based education and training. The ECB’s study suggests that CBDC-related videos could drive widespread adoption by reshaping consumer beliefs. The report states: “Consumers who are shown a short video providing concise and clear communication about the key features of the digital euro are substantially more likely to update their beliefs… which increases their immediate likelihood of adopting it.” No wonder the ECB has ramped up its digital euro video content since late 2024. For example:

3) Preference for Existing Payment Methods – “Europeans have a strong preference for existing payment methods and see no real benefit in a new type of payment system”. While this finding sounds like a positive pushback, it can serve as a precursor to a tactic of technological integrations. “If you can’t beat them, join them” tactic – similarly to the Chinese e-CNY retail CBDC.

A recent Euromoney article highlighted e-CNY’s integration with China’s most popular apps (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay), a move that facilitated its widespread adoption. Despite early struggles, e-CNY now boasts 180 million personal wallet users and a cumulative transaction value of $1 trillion. I recently explored this topic in depth with Roger Huang recently on my podcast.

Not Just Retail—Wholesale Too

On the wholesale CBDC front, the EU is experimenting with distributed ledger technology (DLT) to interconnect financial institutions across Europe and beyond. This follows exploratory work conducted by the Eurosystem between May and November 2024. Their trials involved 64 participants—including central banks, financial market players, and DLT platform operators—conducting over 50 experiments.

Lagarde insists that the Digital Euro is a form of cash, gaslighting and misleading uninformed Europeans about the risks of CBDCs. Permission-based CBDCs such as the Digital Euro are prone to micro levels of control through expiry dates, geofencing and programmability. If Europeans don’t recognize these dangers, they won’t resist the Digital Euro. By framing it as “digital cash,” the ECB ensures smoother public acceptance with little to no public fuss.

To be clear, cash itself is fiat currency—centrally controlled, easily debased, and prone to inflation. Every time the issuer expands the money supply, citizens suffer from declining purchasing power, essentially being robbed by the state.

“Rules for Thee, But Not for Me”

While ordinary citizens are bound by the rule of law, elites often evade consequences. A prime example is Christine Lagarde, who was found guilty of negligence for approving a massive taxpayer-funded payout to controversial French businessman Bernard Tapie. However, she avoided a jail sentence. The Guardian reported in 2016: “A French court convicted the head of the International Monetary Fund and former government minister, who had faced a €15,000 fine and up to a year in prison. But it decided she should not be punished, and that the conviction would not constitute a criminal record. … The IMF gave her its full support.”

My Prediction for the EU’s CBDC

Despite public disinterest, the ECB (and other central banks) will push forward with their CBDCs. To maintain the illusion of public involvement, they will conduct surveys and create engagement tools. But ultimately, the Digital Euro will be integrated into existing payment methods and consumer apps—just as China did with e-CNY. This strategy will drive adoption even without direct public enthusiasm.

We are, after all, playing the game of “democracy,” right?

Geopolitical analyst Alex Krainer recently tweeted in response to Lagarde and von der Leyen’s acceleration of CBDC efforts: “This is excellent news; Christine Lagarde and Ursula von der Leyen never took on something they didn’t completely mess up. I hope they’ll continue with their excellent performance. Godspeed.”

Stay tuned as I continue to track central banks’ moves toward CBDC implementation.

This is a guest post by Efrat Fenigson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.